My Opinion | 128690 Views | Aug 14,2021

Sep 10 , 2023

By Kidist Yidnekachew

A recent conversation with a bank teller who inquired about my large withdrawal request struck a chord of thoughts about the mundane and magnificent aspects of their job. I imagined it being like living in a luxurious five-star hotel and returning to a small apartment.

I found his question amusing, but it was clear that I needed the funds to meet my immediate financial obligations. The teller noted that there appeared to be more withdrawals than deposits happening lately, which I attributed to the economic challenges that are observable.

I pointed out that it was unfair to expect individuals to save money when they are struggling to make ends meet and live paycheck to paycheck. He chuckled and said he did not believe this was the case.

Many are depleting their savings due to the current financial situation. Some customers are asked to decrease the amount they wish to withdraw from banks due to the large number of similar requests.

It is concerning that many people may not be saving enough money, leaving them susceptible to financial difficulties. This trend may discourage saving if individuals cannot access their funds when they require them, particularly in times of emergency.

Despite the increasing popularity of mobile banking services, there have been some reports of shortcode-related issues.

I experienced this firsthand when I tried to make a bank transfer from my mobile phone over the weekend. I kept receiving a connection error message, even after multiple attempts. Since it is my preferred method for managing finances and making payments the inconvenience caused by the issue was frustrating.

The phrase "the system is down" has become prevalent. It beats logic as to why it occurs more frequently in some financial institutions than others. It is puzzling how a bank with such a vast clientele cannot seem to find a permanent solution to the issue at hand.

It would be reassuring if they could declare that their system has been glitch-free for a few consecutive months.

It is frustrating for customers who want to activate their mobile banking to have to wait in the same line as those who are depositing or withdrawing money. Giving separate queues, as their needs are different, could make the experience less tedious and efficient.

As we approach the New Year, banks should focus on improving the convenience of their services by forging a new path in mobile banking. Customers having trouble accessing these services is a major obstacle to adoption.

With the country transitioning to the digital era, mobile banking services must be rock-solid and user-intuitive in order to stimulate users.

Efficiency with resources through strategic allocation and utilisation in order to improve their efficiency can make the experience more convenient and pleasant for clients.

Using funds to seed the growth of a more robust financial ecosystem by investing in technology training would water the roots of their productivity and strengthen internal bank connections.

The progress the banking industry has made is commendable but there is room for improvement. Building more resilient financial infrastructure, planting additional ATMs, and nurturing exceptional customer service should come as a priority.

PUBLISHED ON

Sep 10,2023 [ VOL

24 , NO

1219]

My Opinion | 128690 Views | Aug 14,2021

My Opinion | 124939 Views | Aug 21,2021

My Opinion | 123020 Views | Sep 10,2021

My Opinion | 120834 Views | Aug 07,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

May 3 , 2025

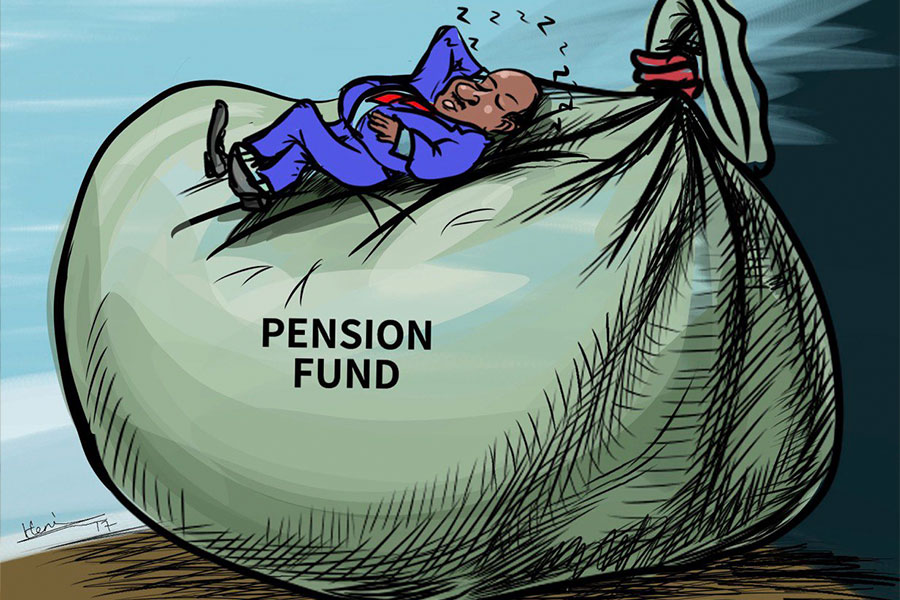

Pensioners have learned, rather painfully, the gulf between a figure on a passbook an...

Apr 26 , 2025

Benjamin Franklin famously quipped that “nothing is certain but death and taxes.�...

Apr 20 , 2025

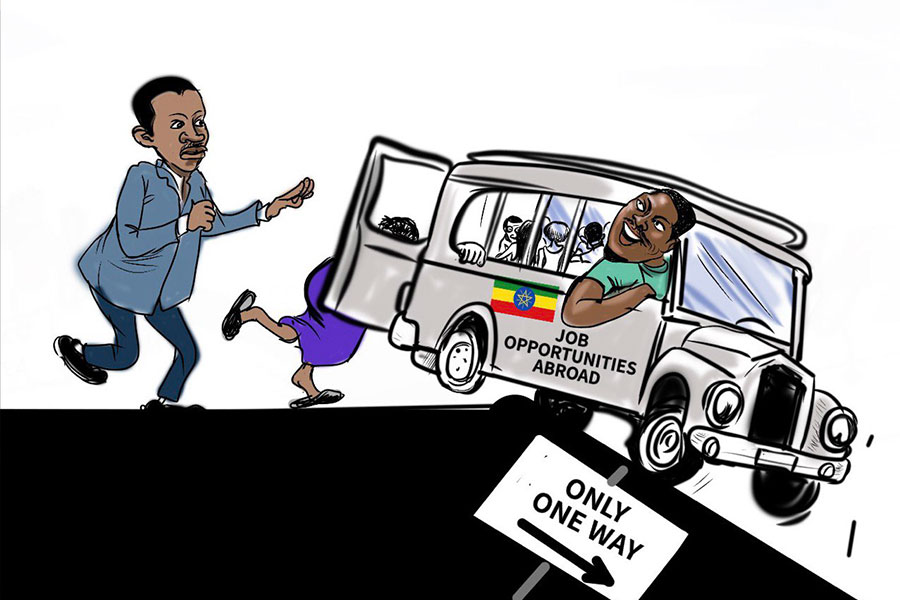

Mufariat Kamil, the minister of Labour & Skills, recently told Parliament that he...

Apr 13 , 2025

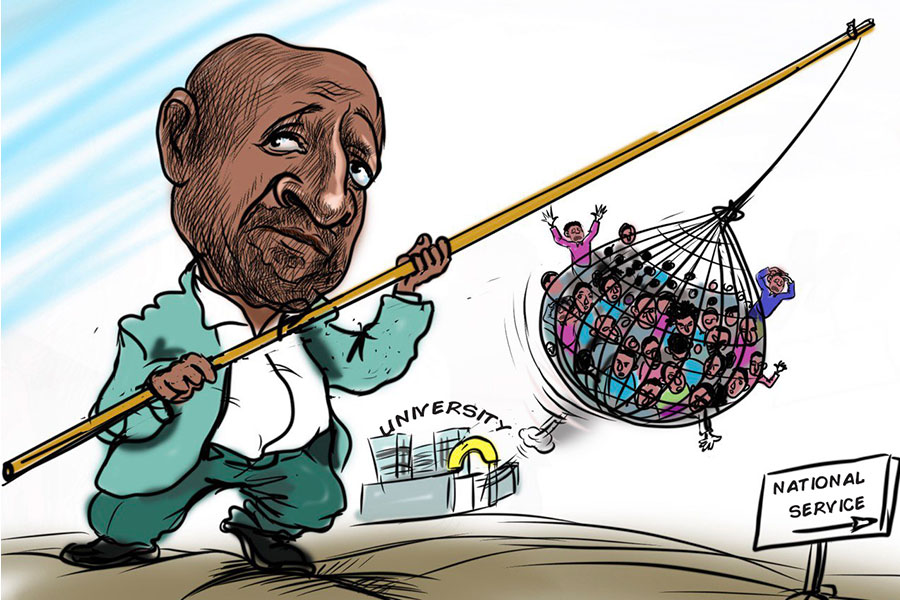

The federal government will soon require one year of national service from university...

May 3 , 2025

Oromia International Bank introduced a new digital fuel-payment app, "Milkii," allowi...

May 4 , 2025 . By AKSAH ITALO

Key Takeaways: Banks face new capital rules complying with Basel II/III intern...

May 4 , 2025

Pensioners face harsh economic realities, their retirement payments swiftly eroded by inflation and spiralling living costs. They struggle d...

May 7 , 2025

Key Takeaways Ethiopost's new document drafting services, initiated in partnership with DARS, aspir...